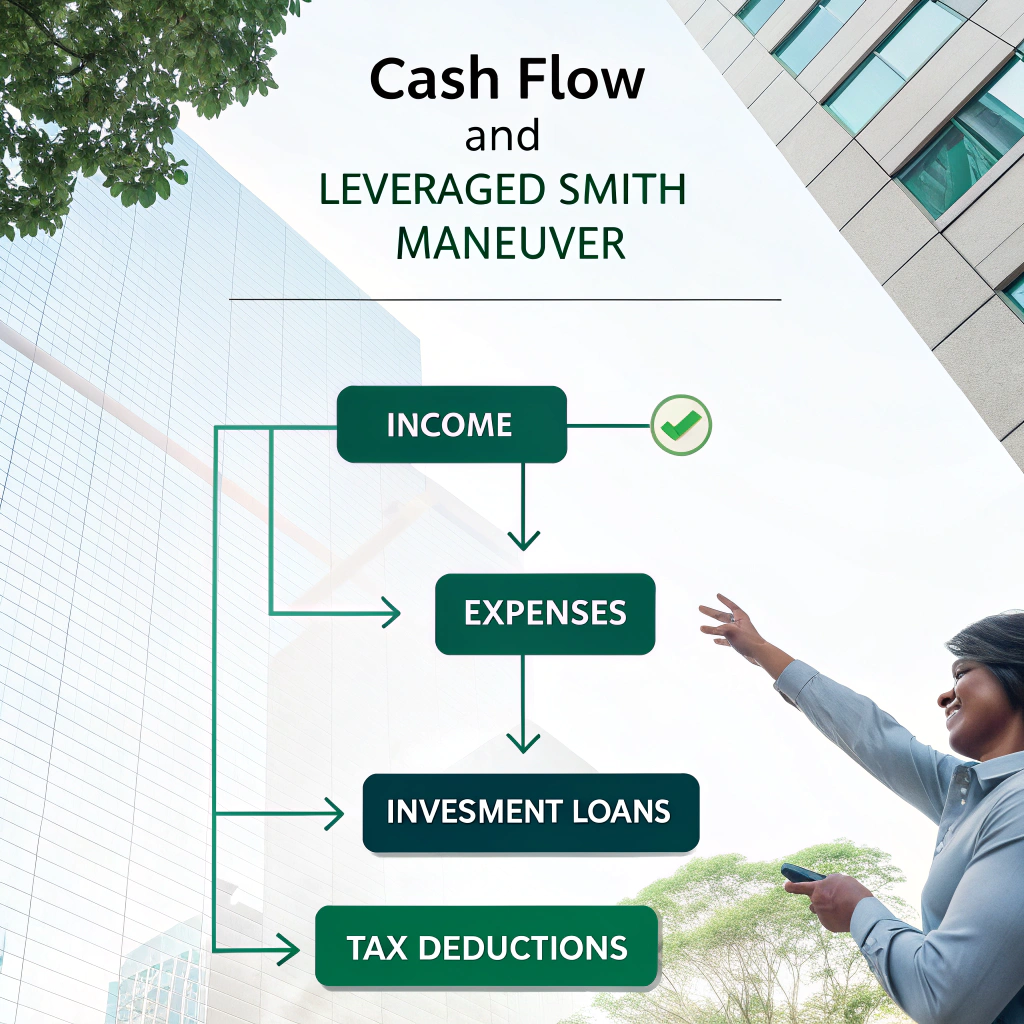

Cash Flow and Leveraged Smith Maneuver

Cash Flow and Leveraged Smith Maneuver: How Buying a Home Improved Our Finances

About two months ago, we bought a home. Working from home because of COVID-19 had an impact on our decision. First, we were a family of five in a small townhouse. Being home all the time made us think that we needed a bigger place. Second, we realized that we could go farther away from downtown Vancouver, where our work was located. I have to admit that buying our home was a wise decision, not only because we have more living space but also because we saw a huge improvement in our cash flow.

As a spending watcher in the family, I was initially worried about the monthly mortgage payments. However, after crunching the numbers, I realized that our cash flow would actually improve. Our new home is in a more affordable area, and the mortgage payment is lower than our previous rent. Additionally, we were able to use the Leveraged Smith Maneuver to our advantage. This strategy involves using the equity in your home to pay off high-interest debt, such as credit cards or car loans. By doing so, we were able to significantly reduce our monthly expenses and free up cash flow for other purposes.

For example, let’s say you have a mortgage payment of $1,500 per month and a credit card debt of $3,000 with an interest rate of 20%. Using the Leveraged Smith Maneuver, you can take out a home equity line of credit (HELOC) for $3,000 and use it to pay off the credit card. Now, you only have the mortgage payment to worry about, which is likely lower than the combined total of your mortgage and credit card payment. Plus, you’ve eliminated the high-interest debt, saving you money in the long run.

Another way to improve your cash flow is to invest in home renovations that increase the value of your property. For instance, adding a bedroom or bathroom can increase the resale value of your home, allowing you to recoup some of the costs when you sell. Furthermore, renovations can make your home more comfortable and enjoyable to live in, which can lead to a higher